Life Insurance, Coverage, Protection, Weatlh and Retirement

Which Type of Coverage is Best?

Which Type of Coverage is Best?

Which Type of Coverage is Best?

Which Type of Coverage is Best ?

Whole Life or Term ?

Making the correct decision is easy when customers become educated by our agents. We can help to guide you with the best option.

WHOLE LIFE INSURANCE

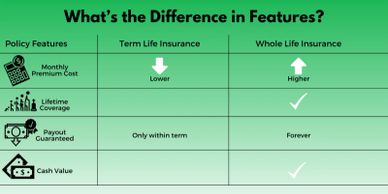

Builds up cash value while you always pay a level premium (payments never goes up in price). Keeps you protected throughout your whole life.

TERM LIFE INSURNCE

Can be more Affordable for many & can pay out a larger face amount. But understand that Term Life does not last forever; just a pre-selected time period.

Term Life Insurance

Which Type of Coverage is Best?

Which Type of Coverage is Best?

Term Life Insurance is Affordable

Keep in mind, the cost for Term Life is calculated according to a person's age and health. This type of Life Insurance coverage is typically a nice temporary solution as it provides a significant amount of coverage for a low cost. Term Life Insurance is temporary and does not build up cash value; usually set to a term anywhere from 10 - 30 years.

Term Life has flexibility; This type of policy allows the chance to at the end of the Term. Plus, there is always an option to convert to Whole Life. Term is Perfect for newlyweds, young couples and those worried about making the mortgage payments, replacing lost income, covering large household costs or dealing with any unforeseen expenses.

Whole Life Insurance

Which Type of Coverage is Best?

Index Universal Life Insurance

Whole Life Insurance is Permanent

Great Bang for your buck - Builds up $$

This type of Life Insurance coverage provides permanent protection for your entire life as long as the policy is in force. In addition, Whole Life Policies can generate a large amount of guaranteed cash value growth which you can access to take withdrawals or loans.

Whole Life insurance costs more for a good reason. Not only is there a death benefit associated with the policy, there is also a substantial cash value build up over time. Furthermore, premiums always remain the same and do not go up in price. Final note, a policy owner can surrender this type of insurance at any time and the cash value will be returned.

Index Universal Life Insurance

Index Universal Life Insurance

Index Universal Life Insurance

Universal Life is Flexible and Builds up $$

Universal Life is popular for those who want to build up a tax free Retirement.

This type of permanent life insurance policy is based off index funds, accumulates cash value growth and is set to provide a large amount of insurance coverage throughout a person's entire life.

Universal Life Insurance policies allow flexible premiums and are typically made up of two parts: A guaranteed death benefit and a nice cash component.

Additionally, this unique type of policy allows earnings to grow tax deferred, meaning tax free accumulation and tax free withdrawals; No taxes going into the policy and no taxes coming out.

Final Expense Insurance

Index Universal Life Insurance

Call for a Quote 630-516-0550

Final Expense covers Burial Costs

Great for Adults & Seniors

Final Expense Insurance can protect your family from the burden of unexpected funeral costs, burial fees, medical bills & other unforeseen expenses.

Many carriers have guaranteed issue plans which means that your acceptance is guaranteed at an affordable cost.

Final Expense Insurance is normally issued as a Whole Life policy which means the policy builds up cash value, price does not go up and the policy is Good for your whole life.

Let's put together a plan to make sure that your family members will be well taken care of in the future.

Call for a Quote 630-516-0550

Index Universal Life Insurance

Call for a Quote 630-516-0550

Life Insurance is a living gift which you can leave for your family.

No matter what your age or health condition, everyone needs a plan in place to protect their loved ones in case something unexpected happens when you are no longer with us.

Browse our Life Insurance Plans, Options,

Don't leave anything to chance. Protect the ones that you love. Just an absolutely wonderful way to ensure that Your Life and Your Legacy can go on.

Let's set up a time to discuss the plans and options.

Health Insurance and Medicare

* Accommodation * Affordable * Analysis * Approval * Assessment * Assistance * Assortment * Attention * Availability * Awareness * Benefits * Budget * Care * Carriers * Claims * Competitive * Comprehensive * Concern * Comfort * Confidence * Consideration * Cost * Courtesy * Coverage * Customer * Detail * Enrollment * Excellence * Expectations * Feedback * Flexibility * Knowledge * Low Rates * Loyalty * Needs * Patience * Peace of Mind * Plans * Premium * Prevention * Price * Products * Professional * Protection * Prudence * Purpose * Quality * Questions * Quotes * Rates * Resources * Satisfaction * Savings * Security * Service * Selection * Support * Technology * Trust * Understanding